One of the key benefits of investing in hard assets like pink diamonds is their potential to not only protect wealth in periods of rising inflation, but actually increase it.

Hard assets like pink diamonds can do this because the increase in their prices tends to more than offset the increase in consumer prices.

As such, they leave investors in these assets in a better off financial position, not only in absolute terms, but especially in relative terms.

This is because most investors, who didn’t have the foresight to invest in hard assets like pink diamonds, often suffer in periods of high inflation as the value of the cash, shares and even property in their portfolio declines.

This is highly relevant today, as the challenge posed by higher inflation is something investors will want to consider, not just in the here and now, but for the decade ahead.

Inflation is back!

It’s been more than forty years since inflation rates were a real problem for investors, having been in a period of decline since their peak in the late 1970s.

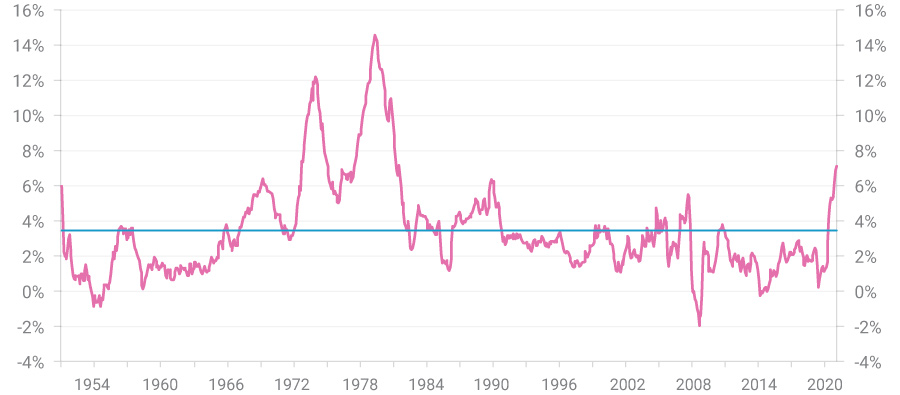

This can be seen in the chart below, which plots the year on year change in inflation rates (pink line) in the United States going all the way back to the start of the 1950s, as well as the average over the entire period (blue line) which was 3.45%.

Inflation rates in the United States

1950 to 2021

Source: St Louis Federal Reserve

As you can see, inflation was a major problem for almost 30 years from the early 1950s through to the start of the 1980s. It averaged more than 4% per annum in that period, peaking at more than 14%.

Since then though, it’s mostly been under control, especially in the last decade up until the end of 2020, with inflation rates averaging less than 2% per annum in this period.

Indeed, inflation has been so low for so long that in April 2019, Bloomberg ran with the below famous headline; “Is inflation dead?”, implying that like the dinosaurs, the challenges posed by higher consumer prices were now extinct.

That year, official inflation rates averaged less than 2%, with the COVID pandemic causing them to fall even further in 2020.

This period almost certainly marked the low point for inflation rates in the United States (and much of the Western world, including Australia), with the official inflation rate rising from just 1.30% in December 2020 to more than 7% in December 2021.

Rather than going the way of the dinosaur, the problem of rising inflation is very much alive.

Going forward, there is good reason to expect inflation rates will be much higher than we have gotten use to in the last couple of decades. The reasons for this include:

- Skyrocketing commodity prices, with oil recently topping USD $90 per barrel, a 7-year high. No wonder petrol in Australia is pushing $2 a litre.

- A potential wage price spiral, as low unemployment rates give workers the power to ask for higher pay. Companies will feel the pressure to oblige, but they’ll also look to pass that cost onto consumers.

- Green energy initiatives. As the world tries to minimise the use of fossil fuels, we will invest less in expanding oil and gas output, ensuring there is continued upward pressure on their prices.

- Supply chain challenges. COVID-19 has shown how risky it is for businesses to focus solely on running the lowest cost supply chains possible. For the next decade, we are likely to see large firms focus on making their supply chains more robust, even if it costs more.

- Signs that inflationary pressures are being felt across the entire economy now, with so called “sticky inflation” (the prices for items that don’t move up or down in price very quickly) now approaching 4% per annum.

Lastly, there is the simple reality that markets move in cycles, some of which take decades to play out. Inflation was a big problem for 30 years, with most investors thinking it would be a permanent issue by the start of the 1980s.

They were wrong.

Inflation then spent most of the last 40 years not being much of a problem, culminating in the above Bloomberg headline, with most investors thinking it would never be a problem again.

They’re probably just as wrong this time around.

Pink diamonds to prosper

Pink diamonds can be expected to continue their recent market leading performance, with the recent spike in inflation, and the strong chance it will remain a problem for years to come a major factor supporting demand going forward.

The 30% return that pink diamonds delivered in the last financial year, and their continued price increases in the several months since, are strong evidence of how sustained this demand is.

And given the Argyle Diamond Mine has now been closed for more than a year (taking more than 90% of the new supply of pink diamonds out of the market), it is only natural that this higher demand continues to put upward pressure on pink diamond prices.

Going forward, we expect to see demand levels increase further, as the more sustained inflation we’ve written about, combined with the volatility and losses that we are likely to see in mainstream assets like equities and bonds encourages more investors to turn to the genuinely scarce, hard asset that pink diamonds are.

As always, we hope you’ve enjoyed this week’s edition of “In the Loupe” and we look forward to any questions or comments you may have.

Inflation wasn’t dead after all!

One of the key benefits of investing in hard assets like pink diamonds is their potential to not only protect wealth in periods of rising inflation, but actually increase it.

Hard assets like pink diamonds can do this because the increase in their prices tends to more than offset the increase in consumer prices.

As such, they leave investors in these assets in a better off financial position, not only in absolute terms, but especially in relative terms.

This is because most investors, who didn’t have the foresight to invest in hard assets like pink diamonds, often suffer in periods of high inflation as the value of the cash, shares and even property in their portfolio declines.

This is highly relevant today, as the challenge posed by higher inflation is something investors will want to consider, not just in the here and now, but for the decade ahead.

Inflation is back!

It’s been more than forty years since inflation rates were a real problem for investors, having been in a period of decline since their peak in the late 1970s.

This can be seen in the chart below, which plots the year on year change in inflation rates (pink line) in the United States going all the way back to the start of the 1950s, as well as the average over the entire period (blue line) which was 3.45%.

Inflation rates in the United States

1950 to 2021

Source: St Louis Federal Reserve

As you can see, inflation was a major problem for almost 30 years from the early 1950s through to the start of the 1980s. It averaged more than 4% per annum in that period, peaking at more than 14%.

Since then though, it’s mostly been under control, especially in the last decade up until the end of 2020, with inflation rates averaging less than 2% per annum in this period.

Indeed, inflation has been so low for so long that in April 2019, Bloomberg ran with the below famous headline; “Is inflation dead?”, implying that like the dinosaurs, the challenges posed by higher consumer prices were now extinct.

That year, official inflation rates averaged less than 2%, with the COVID pandemic causing them to fall even further in 2020.

This period almost certainly marked the low point for inflation rates in the United States (and much of the Western world, including Australia), with the official inflation rate rising from just 1.30% in December 2020 to more than 7% in December 2021.

Rather than going the way of the dinosaur, the problem of rising inflation is very much alive.

Going forward, there is good reason to expect inflation rates will be much higher than we have gotten use to in the last couple of decades. The reasons for this include:

Lastly, there is the simple reality that markets move in cycles, some of which take decades to play out. Inflation was a big problem for 30 years, with most investors thinking it would be a permanent issue by the start of the 1980s.

They were wrong.

Inflation then spent most of the last 40 years not being much of a problem, culminating in the above Bloomberg headline, with most investors thinking it would never be a problem again.

They’re probably just as wrong this time around.

Pink diamonds to prosper

Pink diamonds can be expected to continue their recent market leading performance, with the recent spike in inflation, and the strong chance it will remain a problem for years to come a major factor supporting demand going forward.

The 30% return that pink diamonds delivered in the last financial year, and their continued price increases in the several months since, are strong evidence of how sustained this demand is.

And given the Argyle Diamond Mine has now been closed for more than a year (taking more than 90% of the new supply of pink diamonds out of the market), it is only natural that this higher demand continues to put upward pressure on pink diamond prices.

Going forward, we expect to see demand levels increase further, as the more sustained inflation we’ve written about, combined with the volatility and losses that we are likely to see in mainstream assets like equities and bonds encourages more investors to turn to the genuinely scarce, hard asset that pink diamonds are.

As always, we hope you’ve enjoyed this week’s edition of “In the Loupe” and we look forward to any questions or comments you may have.

Related posts: