It’s been another eventful week for investors.

On the positive side, employment figures are rock solid, especially in Australia, with the local unemployment rate dropping to just 3.5%, its lowest level since the early 1970s.

Stock markets are also finding buyers right now, though they’ve only seen very small bounces relative to the declines seen in the first half of the year.

Negative news has included a continued rise in inflation, with headline growth in consumer prices now topping 9% per annum in the United States, though a recent pullback in energy prices has many hoping we will soon see the peak in this inflationary cycle.

Meanwhile in Australia, housing markets have continued to weaken, with prices now declining across the East Coast, with Sydney and Melbourne leading the fall.

In this week’s article, we discuss the launch of a new pink diamond fund providing investors with a new way to access the pink diamond market.

We look at both what the fund launch means for demand and the potential price trajectory of these unique assets, as well as how funds like this compare to the more traditional way of investing in diamonds, including the services we offer at Australian Diamond Portfolio.

A pink diamond like those available in the new investment fund, and direct via Australian Diamond Portfolio.

Pink diamond demand growing

Since Australian Diamond Portfolio was launched in 2013, we’ve been fortunate to work with thousands of astute clients who’ve chosen to diversify their portfolios with an investment in pink diamonds, which have been one of the best performing assets of the last twenty years.

Over this time period, we’ve witnessed first-hand the growth in the market, not just in terms of rising prices, but how much more widespread ownership has become, with SMSF trustees, and regular investors now accessing this asset class.

At Australian Diamond Portfolio, we’ve also seen an evolution in how pink diamonds are marketed and sold to potential investors.

To that end, we noted with interest a recent story in the Australian Financial Review about a new ‘pink diamond fund’ that aims to capitalise on the growth in the pink diamond market.

Titled ‘Hero Diamonds form basis of Tribeca’s new $50m fund’, the article notes that the fund manager (Tribeca), have partnered with an Australian jewellery designer to form what is being called “the Kimberly Syndicate”.

Based on the article, the Syndicate appears to have purchased a range of hero diamonds form Argyle Tenders, including the Argyle Thea Radiant, the Argyle Imperial Violet Shield, and the Argyle Red Heart.

Reports suggest the Syndicate hopes to turn a profit for investors by adding value to these diamonds by designing them into ultra-high-end jewellery pieces.

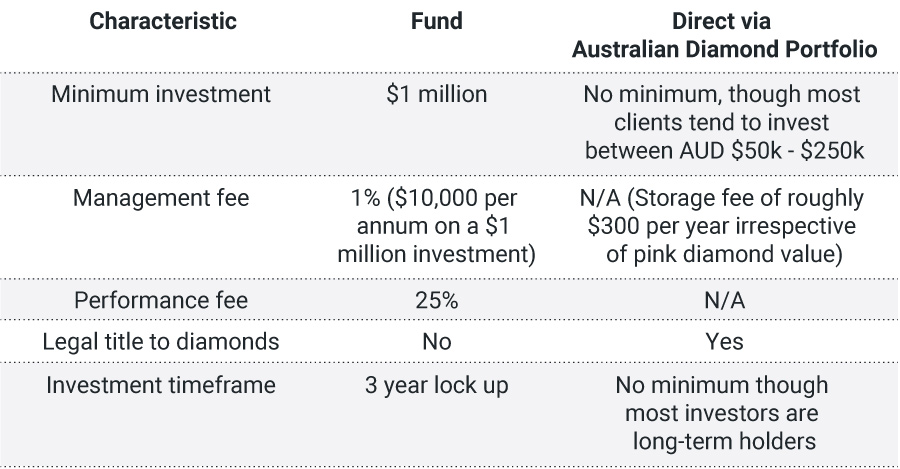

With a minimum investment of $1 million, investments in this fund are obviously targeted toward ultra-high-net worth investors, who will also need to pay a management fee of 1% per annum, and a 25% performance fee.

The below table highlights some of the differences between investing in a fund like this, versus buying a pink diamond directly from Australian Diamond Portfolio, again noting that this is based on media reports for the fund.

Given the above differences, we think most potential pink diamond investors will still prefer to ‘go direct’.

The costs of holding a pink diamond investment will be much lower, while the minimum entry point in terms of how much you need to invest also means going direct is more practical for most investors.

Note that this is not in any way a critique of pink diamond funds. Indeed, we are thrilled to see financial products like this come to market, as it’s further evidence of the strong demand for pink diamonds from investors, which will help push prices higher in years to come.

Pink Diamonds vs Key Assets!

The team at Australian Diamond Portfolio are busy putting the finishing touches on the end June 2022 figures for the Australian Diamond Portfolio Pink Diamond Index (ADPPDI), which will be released in early August.

Our end of financial year report, which will include the ADPPDI results will also look at the performance of more mainstream, or traditional assets, from Australian home prices, to regular superannuation funds.

Without wanting to give the game away, we think existing investors in pink diamonds will be pleasantly surprised with the results, not only in absolute terms in the sense of how much pink diamond prices have risen, but in relative terms as well.

They really are the asset class to own these days, with the closure of the Argyle Mine continuing to turbocharge both demand, and pink diamond prices.

Watch this space!

As always, we hope you’ve enjoyed this week’s edition of “In the Loupe” and we look forward to any questions or comments you may have.

Investor demand for pink diamonds keeps growing!

It’s been another eventful week for investors.

On the positive side, employment figures are rock solid, especially in Australia, with the local unemployment rate dropping to just 3.5%, its lowest level since the early 1970s.

Stock markets are also finding buyers right now, though they’ve only seen very small bounces relative to the declines seen in the first half of the year.

Negative news has included a continued rise in inflation, with headline growth in consumer prices now topping 9% per annum in the United States, though a recent pullback in energy prices has many hoping we will soon see the peak in this inflationary cycle.

Meanwhile in Australia, housing markets have continued to weaken, with prices now declining across the East Coast, with Sydney and Melbourne leading the fall.

In this week’s article, we discuss the launch of a new pink diamond fund providing investors with a new way to access the pink diamond market.

We look at both what the fund launch means for demand and the potential price trajectory of these unique assets, as well as how funds like this compare to the more traditional way of investing in diamonds, including the services we offer at Australian Diamond Portfolio.

A pink diamond like those available in the new investment fund, and direct via Australian Diamond Portfolio.

Pink diamond demand growing

Since Australian Diamond Portfolio was launched in 2013, we’ve been fortunate to work with thousands of astute clients who’ve chosen to diversify their portfolios with an investment in pink diamonds, which have been one of the best performing assets of the last twenty years.

Over this time period, we’ve witnessed first-hand the growth in the market, not just in terms of rising prices, but how much more widespread ownership has become, with SMSF trustees, and regular investors now accessing this asset class.

At Australian Diamond Portfolio, we’ve also seen an evolution in how pink diamonds are marketed and sold to potential investors.

To that end, we noted with interest a recent story in the Australian Financial Review about a new ‘pink diamond fund’ that aims to capitalise on the growth in the pink diamond market.

Titled ‘Hero Diamonds form basis of Tribeca’s new $50m fund’, the article notes that the fund manager (Tribeca), have partnered with an Australian jewellery designer to form what is being called “the Kimberly Syndicate”.

Based on the article, the Syndicate appears to have purchased a range of hero diamonds form Argyle Tenders, including the Argyle Thea Radiant, the Argyle Imperial Violet Shield, and the Argyle Red Heart.

Reports suggest the Syndicate hopes to turn a profit for investors by adding value to these diamonds by designing them into ultra-high-end jewellery pieces.

With a minimum investment of $1 million, investments in this fund are obviously targeted toward ultra-high-net worth investors, who will also need to pay a management fee of 1% per annum, and a 25% performance fee.

The below table highlights some of the differences between investing in a fund like this, versus buying a pink diamond directly from Australian Diamond Portfolio, again noting that this is based on media reports for the fund.

Given the above differences, we think most potential pink diamond investors will still prefer to ‘go direct’.

The costs of holding a pink diamond investment will be much lower, while the minimum entry point in terms of how much you need to invest also means going direct is more practical for most investors.

Note that this is not in any way a critique of pink diamond funds. Indeed, we are thrilled to see financial products like this come to market, as it’s further evidence of the strong demand for pink diamonds from investors, which will help push prices higher in years to come.

Pink Diamonds vs Key Assets!

The team at Australian Diamond Portfolio are busy putting the finishing touches on the end June 2022 figures for the Australian Diamond Portfolio Pink Diamond Index (ADPPDI), which will be released in early August.

Our end of financial year report, which will include the ADPPDI results will also look at the performance of more mainstream, or traditional assets, from Australian home prices, to regular superannuation funds.

Without wanting to give the game away, we think existing investors in pink diamonds will be pleasantly surprised with the results, not only in absolute terms in the sense of how much pink diamond prices have risen, but in relative terms as well.

They really are the asset class to own these days, with the closure of the Argyle Mine continuing to turbocharge both demand, and pink diamond prices.

Watch this space!

As always, we hope you’ve enjoyed this week’s edition of “In the Loupe” and we look forward to any questions or comments you may have.

Related posts: