‘Oppenheimer Blue’ diamond smashes estimates, sells for world record A$80 million

A recent spate of eye-popping bids at Geneva’s semi-annual magnificent jewel auctions has highlighted the surging value of precious stones, with some of the world’s ultra-rich increasingly investing in hard assets as a safeguard against stock market volatility.

“When you buy a Picasso, you pay a lot, but you know you are going to sell it for even more.”

The “Oppenheimer Blue”, the largest and finest fancy vivid blue diamond ever offered at auction, sold for a world record 56.837 million Swiss francs ($80.71 million) on Wednesday after dramatic see-saw bidding, Christie’s said.

“It’s the most expensive jewel ever sold at auction,” said Christie’s spokeswoman Alexandra Kindermann.

The rare rectangular-cut stone, which weighs 14.62 carats, previously belonged to Sir Philip Oppenheimer, who controlled the Diamond Syndicate in London.

Before the auction experts ad said it was in with a chance of beating the record of $48.4 million set by Sotheby’s in November with Hong Kong billionaire Joseph Lau’s purchase of the 12.03-carat “Blue Moon of Josephine”.

The packed Geneva saleroom broke into applause as Rahul Kadakia, Christie’s International Head of Jewellery, brought down the hammer after two phone bidders ended a 20-minute battle for the gem.

The buyer’s identity was not immediately known.

Sotheby’s fetched a record price in the Fancy Vivid Pink Category on Tuesday, when a private buyer in Asia scooped up a 15.38-carat stone for $31.6 million.

Ehud Laniado, president of Cora International, which sold the stone dubbed “Unique Pink”, said he was “very happy with the sale price”, and voiced confidence that the gem’s value would rise over time.

“When you buy a Picasso, you pay a lot, but you know you are going to sell it for even more,” he said.

Surge in diamond prices amid volatile share market

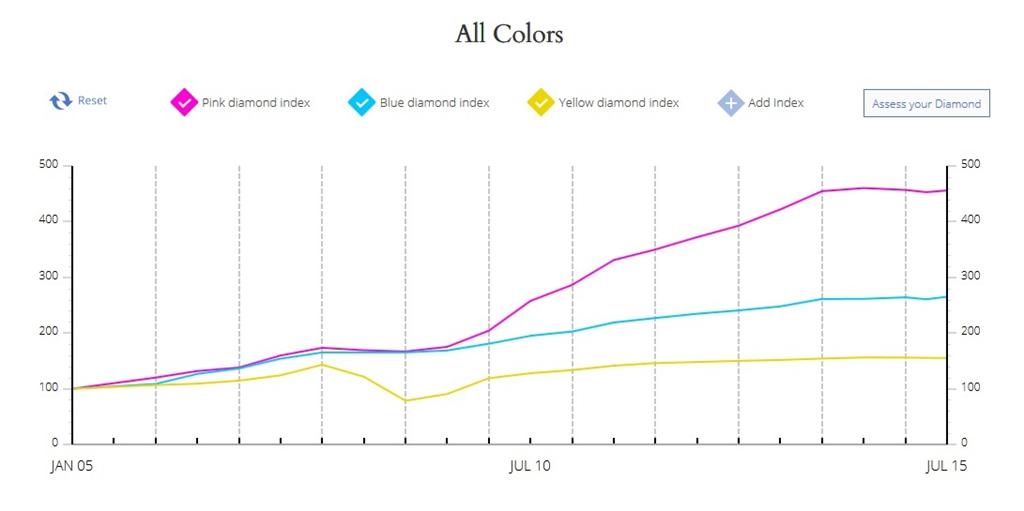

A recent spate of eye-popping bids at Geneva’s semi-annual magnificent jewel auctions has highlighted the surging value of precious stones, with some of the world’s ultra-rich increasingly investing in hard assets as a safeguard against stock market volatility.

Britain’s Sir Philip Oppenheimer (1911-1995) led a powerful cartel called the Central Selling Organization for 45 years, tightly controlling roughly 80 percent of the international diamond trade in a bid to prevent wild price swings.

Among his major credits was convincing the Soviet Union to sell its significant diamond reserves through his London-based cartel.

De Beers, the giant mining company built by the Oppenheimer family, also flourished in the latter half of the 20th century, thanks in part to Sir Philip’s outsized influence in the sector.

The blue stone has passed through several hands since Oppenheimer’s death and this week marked its first appearance at public auction.

“As a general rule, these stones are quite small,” said Christie’s diamond expert Jean-Marc Lunel, noting that a Fancy Vivid Blue weighing just five carats typically generates considerable buzz in the diamond market.

Last week, Canadian mining company Lucara Diamond announced the sale of a huge 813-carat uncut diamond for a record $63 million ($66.8 million).

The name of the buyer for the gem, which was discovered in Botswana, was not divulged, nor the conditions of the sale overseen by Nemesis International.

That record sale figure for a rough diamond is unlikely to last very long.

Lucara is preparing to auction an even larger 1,109-carat diamond at Sotheby’s in London on June 29.

Published December 11 2015 by Barron’s

Published December 11 2015 by Barron’s

Source: Rapaport News August 25, 2015

Source: Rapaport News August 25, 2015

Bullish Australian Dollar adds sparkle to investment diamonds

MARKET COMMENTARY: The AUD/USD had a terrific week, this morning trading at just over 0.74 Australian cents to the US Dollar. The Aussie has now rallied 8.3% since January 15th, significantly outperforming expectations as a week of positive economic surprises has helped. The Australian economy is growing faster than expected, commodity prices have increased with iron ore extending its 19% gain last month, and a falling US Dollar have all been factors supporting our unexpected stronger currency.

This translates into a favourable buying opportunity for investors looking at making additions to their diamond portfolios. Just as with commodities such as oil and gold, diamonds around the world are traded in US Dollars. This means that the higher the Australian dollar is worth against the US Dollar, the lower the price in AUD for the same diamonds, even though the intrinsic value remains the same.

What will happen short-term with the AUD is anyone’s guess considering the degree of volatility across currency markets, but many economists believe these gains to be a short-term corrective rally, predicting an overall weakening trend in the Aussie as the year continues. Some believe the AUD could go as low as 50 cents vs. the USD with continued volatility in commodity prices and concerns over soft Chinese growth weighing on the local currency.

A growing number of economists also say that if the surge in the Aussie continues, the Reserve Bank of Australia might have to cut interest rates to less than the current 2%.

“If the currency gets up into the high US 70 cents, the Reserve Bank may well consider cutting interest rates again,” independent economist Saul Eslake told Bloomberg at the weekend.

“We know [the RBA] prefer the Aussie to be trading closer to US 65 cents and, given that we are nearly [US10 cents] away from that level, there’s a risk of currency-related comments from RBA officials,” says Kathy Lien, BK Asset Management’s director of foreign exchange strategy.

The key takeaway here for diamond buyers is that these unexpected developments in our currency present an excellent buying opportunity, whether adding to existing holdings or getting into the market for the first time.

Until next time,

Anna Cisecki, Executive Director