This week’s market update has a distinctly local focus, looking at using superannuation to invest in pink diamonds.

Based on the feedback we regularly receive, this is a subject that we know is of huge interest to our client base, which is no surprise given that superannuation is in many cases becoming the largest financial asset most Australians are building.

Below, we discuss the trends in the superannuation space, along with a statement released by the Australian Taxation Office (ATO) regarding purchasing pink diamonds inside a SMSF.

Please do note, the following is for informational purposes only, and does not constitute financial advice, either general or specific. You should assess whether the information is appropriate to your individual financial circumstances before making an investment decision.

Buying pink diamonds using superannuation

Given that most of us won’t be able to touch our superannuation until we retire, or are in our mid-60s at the earliest, it’s understandable why it isn’t always top of mind for some people when it comes to managing their investments.

That said, there are huge advantages to taking a very keen interest in your superannuation at an early age, especially when one considers that the government mandates that employers pay 11% (and rising) of worker salaries into super.

These compulsory contributions, together with market growth, have seen the total superannuation pool grow to more than AUD $3.5 trillion in September 2023, according to ASFA.

Furthermore, it will only grow from here, with the following table showing just how large the superannuation industry could grow in the next 15 years.

Source: ASFA

Make no mistake – superannuation matters to any Australian wanting to maximise their financial wealth.

With a strong history of price growth, as well as the range of benefits that investors have seen, it’s natural that more Australians are looking at using their super to invest in pink diamonds.

To do this, one must have a Self-Managed Superannuation Fund (SMSF), which gives the individual, or couple running the SMSF legal control of the assets, and greater choice over which assets they can invest in.

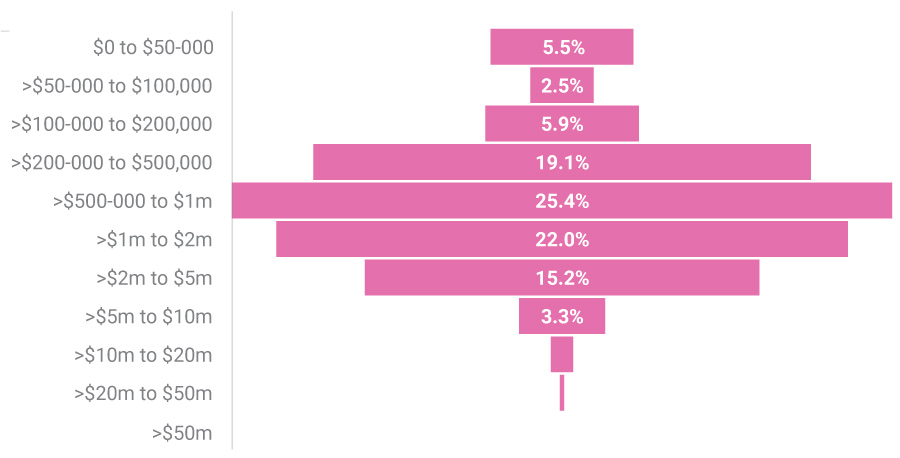

And while many people think you need a huge sum of money to start and run a SMSF, the reality is far different, with recent research suggesting a large portion of trustees (circa 25%) are now starting SMSFs with $500k or less.

Proportion of SMSF funds, by asset range of fund

Source: FirstLinks

Using a SMSF to buy pink diamonds

While we are not financial advisors at Australian Diamond Portfolio, and can’t advise whether you should buy pink diamonds in your SMSF, or manage your own SMSF, we do pay attention to what is going on in the sector.

Indeed, our services include a variety of options that many SMSF trustees seek, including storage and insurance.

To this end, we were pleased to see a December 2023 update from the ATO that specifically relates to pink diamonds and investing in them using a SMSF. The ATO stated that they had recently been asked if pink diamonds are classified as collectable or personal use assets.

The ATO noted in reply to this question that, “Natural diamonds (including pink diamonds), when held in loose form, are not considered collectable or personal use assets under the superannuation legislation and as such do not have specific storage and insurance requirements.

Trustees and auditors should note these rules only apply for ‘diamonds held in loose form’. This means the diamond cannot in any way be mounted, integrated into or used as an item for adornment or other purposes which would be inconsistent with the holding of the diamond in loose form for investment purposes.”

The ATO went on to clarify their position in the publication, noting that; “Despite not being subject to specific requirements, we would recommend trustees hold adequate insurance and consider appropriate storage arrangements for these types of assets. These are sound practices when protecting a fund’s assets.”

We were incredibly pleased to see this clarification from the ATO, for three key reasons.

- Firstly, the very fact that the ATO has seen fit to comment specifically on pink diamonds inside a SMSF is a clear sign that pink diamonds are making their way to becoming more mainstream assets. If you are thinking of buying them using your SMSF, you are far from alone, with thousands of Australians doing the same thing.

- Secondly, the ruling from the ATO itself makes it easier and more cost effective for Australians to invest in pink diamonds using their SMSF going forward.

- Lastly, we were pleased to see the ATO’s clarifying point regarding what it would consider best practice for owning pink diamonds using a SMSF.

This is because, as mentioned above, Australian Diamond Portfolio’s entire investment process is designed to factor in storage and insurance, should the SMSF investor so desire it.

As always, we hope you’ve enjoyed this week’s edition of “In the Loupe” and we look forward to any questions or comments you may have.

Superannuation, the ATO, and pink diamonds

This week’s market update has a distinctly local focus, looking at using superannuation to invest in pink diamonds.

Based on the feedback we regularly receive, this is a subject that we know is of huge interest to our client base, which is no surprise given that superannuation is in many cases becoming the largest financial asset most Australians are building.

Below, we discuss the trends in the superannuation space, along with a statement released by the Australian Taxation Office (ATO) regarding purchasing pink diamonds inside a SMSF.

Please do note, the following is for informational purposes only, and does not constitute financial advice, either general or specific. You should assess whether the information is appropriate to your individual financial circumstances before making an investment decision.

Buying pink diamonds using superannuation

Given that most of us won’t be able to touch our superannuation until we retire, or are in our mid-60s at the earliest, it’s understandable why it isn’t always top of mind for some people when it comes to managing their investments.

That said, there are huge advantages to taking a very keen interest in your superannuation at an early age, especially when one considers that the government mandates that employers pay 11% (and rising) of worker salaries into super.

These compulsory contributions, together with market growth, have seen the total superannuation pool grow to more than AUD $3.5 trillion in September 2023, according to ASFA.

Furthermore, it will only grow from here, with the following table showing just how large the superannuation industry could grow in the next 15 years.

Source: ASFA

Make no mistake – superannuation matters to any Australian wanting to maximise their financial wealth.

With a strong history of price growth, as well as the range of benefits that investors have seen, it’s natural that more Australians are looking at using their super to invest in pink diamonds.

To do this, one must have a Self-Managed Superannuation Fund (SMSF), which gives the individual, or couple running the SMSF legal control of the assets, and greater choice over which assets they can invest in.

And while many people think you need a huge sum of money to start and run a SMSF, the reality is far different, with recent research suggesting a large portion of trustees (circa 25%) are now starting SMSFs with $500k or less.

Proportion of SMSF funds, by asset range of fund

Source: FirstLinks

Using a SMSF to buy pink diamonds

While we are not financial advisors at Australian Diamond Portfolio, and can’t advise whether you should buy pink diamonds in your SMSF, or manage your own SMSF, we do pay attention to what is going on in the sector.

Indeed, our services include a variety of options that many SMSF trustees seek, including storage and insurance.

To this end, we were pleased to see a December 2023 update from the ATO that specifically relates to pink diamonds and investing in them using a SMSF. The ATO stated that they had recently been asked if pink diamonds are classified as collectable or personal use assets.

The ATO noted in reply to this question that, “Natural diamonds (including pink diamonds), when held in loose form, are not considered collectable or personal use assets under the superannuation legislation and as such do not have specific storage and insurance requirements.

Trustees and auditors should note these rules only apply for ‘diamonds held in loose form’. This means the diamond cannot in any way be mounted, integrated into or used as an item for adornment or other purposes which would be inconsistent with the holding of the diamond in loose form for investment purposes.”

The ATO went on to clarify their position in the publication, noting that; “Despite not being subject to specific requirements, we would recommend trustees hold adequate insurance and consider appropriate storage arrangements for these types of assets. These are sound practices when protecting a fund’s assets.”

We were incredibly pleased to see this clarification from the ATO, for three key reasons.

This is because, as mentioned above, Australian Diamond Portfolio’s entire investment process is designed to factor in storage and insurance, should the SMSF investor so desire it.

As always, we hope you’ve enjoyed this week’s edition of “In the Loupe” and we look forward to any questions or comments you may have.

Related posts: