The Reasons to buy Diamonds get stronger by the week!

Up and down the East coast of Australia, it seems almost everyone is focused on the property market.

This is something we expect will continue for the foreseeable future with the Federal election now less than a month away, and a range of changes to how property is taxed set to be implemented in the months that follow.

And whilst many property investors are hoping that the decline in house prices is over, it’s not looking that way, with research from Morgan Stanley suggesting house price falls will continue for the rest of the year at the very least.

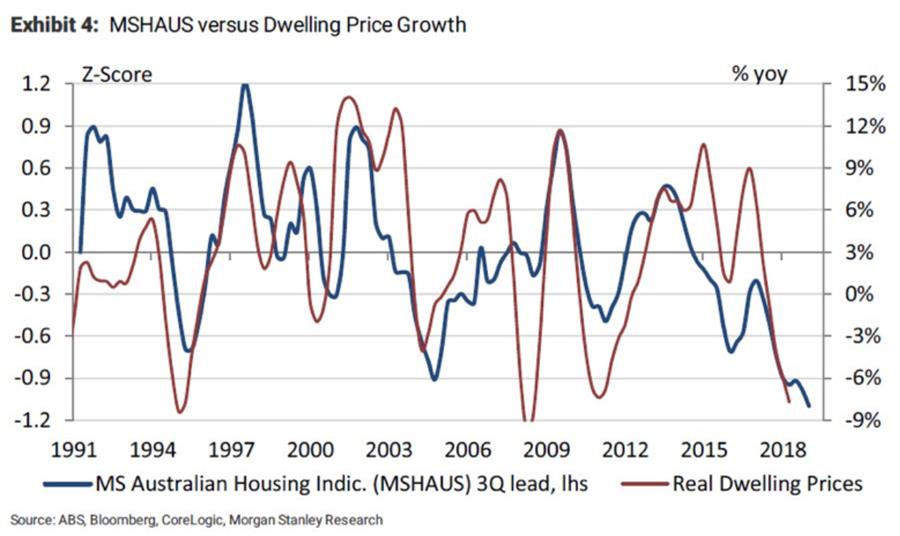

The chart below, which comes from Morgan Stanley, shows the movement in their own proprietary housing market model, and the change in house prices, over the past 25 plus years.

As you can see, they are highly correlated, and it suggests further price declines ahead; with Morgan Stanley stating; “housing weakness is likely to persist through to the end of the year at least, with further downside to both approvals and prices.”

Developments in the local housing market will likely spur rare coloured diamond demand and prices for a handful of reasons.

The first and most obvious is that as prices fall, investors will look for alternative assets to protect and grow their capital.

Rare coloured diamonds will be one such asset class that will benefit from these capital flows.

The second reason has to do with interest rates.

The house price outlook would likely be enough to cause the Reserve Bank to cut rates in time, but couple it with extremely low levels of official inflation (we get another read on this economic data point today), and markets are starting to think the RBA will cut rates to just 1% within the next year.

This will punish savers and cause those sitting on cash and term deposits to look for alternatives, whilst the impact lower rates will have on the currency should also stimulate demand for rare coloured diamonds.

Diamonds are Discrete Wealth

One of the key drivers of diamond demand is the fact that they offer a form of discrete wealth. By this we mean they are physical tangible assets that can be stored outside of the financial system, and they are also easily transportable.

Demand for diamonds as a discrete form of wealth has become particularly well established over the past 15 years, as economies have suffered from financial crises, and central banks have responded with low, or even negative interest rates, and even money printing.

Over the Easter weekend, we came across an interesting and frankly alarming report, which was published by the IMF, back in February 2019, which we think will only strengthen demand for diamonds in the years to come.

Titled, ‘Cashing In: How to Make Negative Interest Rates Work’, the report discussed how central banks and politicians can force savers to accept negative interest rates on their money.

In essence, the IMF propose a two-tiered system within a country, one for “e-money” (the money in your bank account) and one for physical cash. “E-money” will get charged whatever negative rate of interest the central banks decide, whilst physical cash will get charged a conversion rate whenever savers try and spend their money, or put it into the banking system.

That conversion rate would be equivalent to the negative interest rate the central bank has decided is appropriate to charge on “e-money”.

We could write for hours on the impracticality, immorality and sheer lunacy of this idea, but the long and the short of it is that no matter what you try and do, politicians and policymakers are going to punish people who have saved up their capital.

Those who want to protect as well as enhance their wealth in the years ahead are going to need trusted, tangible safe havens.

Rare coloured diamonds are undoubtedly one of the solutions those investors will turn to.

Diamond News:

Whilst most of our clients at ADP invest in rare coloured diamonds based on the impressive supply and demand fundamentals underpinning the market, the strong long-term returns, and the diversification benefits that diamonds offer, stories about ‘once in a lifetime’ finds always generate interest.

To that end, the Okavango Diamond Company, based out of Botswana, recently announced that they have found the largest blue diamond ever discovered in the country.

Called “The Okavango Blue”, the diamond is 20.46 carats, and can be expected to fetch upwards of $250m when it goes to auction later this week.