Interest Rate Cuts are Coming

The big news of the week in Australia was the decision by the Reserve Bank of Australia (RBA) to hold interest rates steady yesterday, with the cash rate still sitting at 0.75%.

Throughout January, there was some speculation that the RBA would cut rates this week, bringing them to a new all-time low of just 0.50%, with fears of the economic contagion caused by the coronavirus outbreak one of the factors supporting a rate cut.

Some commentators even suggested the RBA should “shock the market” and cut rates by 0.50% or even 0.75%, bringing interest rates all the way to zero, in a clear sign that the central bank would do all it could to push the value of our currency lower, in the hope it would stimulate the economy.

Thankfully, saner heads have prevailed for now (and we really must stress the “for now” part), with stronger than expected employment data in late January and a pick-up in house prices enough to see the RBA stay put.

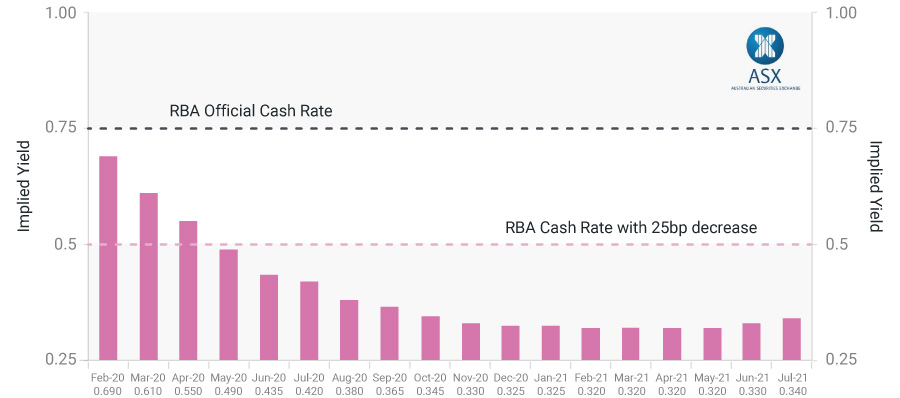

Make no mistake though, interest rate cuts are coming in 2020, with expectations (seen below in this chart from the ASX), suggesting the market has now fully priced in a rate cut by May of this year, with the potential for further easing seen in the second half of 2020.

ASX 30 Day Interbank Cash Rate Futures Implied Yield Curve

As at market close on 3rd February 2020

Source: ASX. ASX disclaimer: This document provides general information and is indicative only. It is not investment advice and readers should seek their own professional advice in assessing the effects of the information in their circumstances. ASX limited and its related corporations accept no responsibility for errors or omissions, including negligence , or for any damage loss or claim arising from reliance on the information. Futures and options trading involves he potential for both profits and losses and only licensed brokers and advisors can advise on the risk.

How Much Could Pink Diamonds Go Up?

Regular readers of In the Loupe will be aware of the wealth generating potential pink diamonds offer, and why they are best seen as a long-term investment, with a five to ten-year investment time horizon at a minimum.

We are often asked what kind of returns investors can expect in this space. This will obviously be influenced by multiple factors, including the size of the investment a person makes, the timeframe they hold for, and the type of pink diamond or diamonds they end up investing in.

The following chart plots the value of a pink diamond portfolio both now and in 2030, based on a range of initial investments, and using a forecast annual return of 11.94%.

This return is in line with the average historical USD pink diamond price for the three main categories of pink diamonds we source for clients at Australian Diamond Portfolio.

We’ve used three initial investment figures, starting at AUD $25,000 through to $100,000. $50,000 represents a standard investment level for Australian Diamond Portfolio clients.

Potential Investment Growth over 10 years for Pink Diamonds

read more