Coloured diamonds outshine whites as top mine’s sparkle fades

Pink and violet stones surge in value amid uncertainty over site where 90% are found.

Over a quarter of a century Larry West has scoured the globe looking for some of the world’s rarest coloured diamonds. This week he secured a big prize, the Argyle Violet, which he bought along with 15 other coloured stones for more than $10m.

“At 2.83 carats, this is the largest and most valuable violet diamond ever recovered from the Argyle mine,” says Mr West, founder of New York’s LJ West Diamonds. “You could fill a garbage truck with the rough diamonds produced from the mine every year, an ashtray with pink diamonds but only a half teaspoon of violets,” he says.

Rio Tinto’s Argyle mine, which is based in the remote north-west of Australia, produces about 90 per cent of the top-quality red, pink and violet diamonds dug up worldwide. The stones are extraordinarily rare, accounting for 0.1 per cent of the mine’s annual output with the remainder made up of more affordable champagne and cognac stones used in the fashion jewellery sector in the US, China and India.

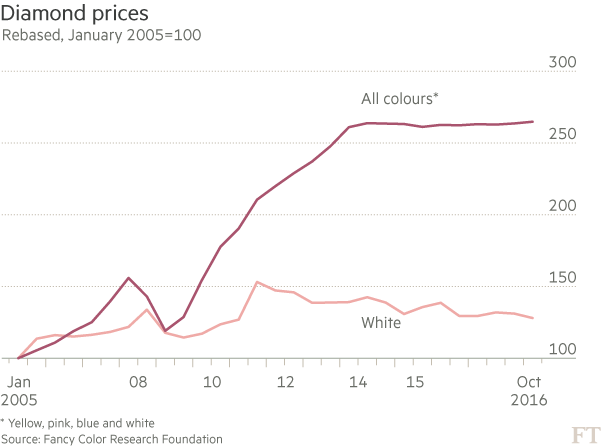

Uncertainty over the Argyle mine’s future, as well as growing appreciation for rare pink diamonds among the super-rich, is prompting a surge in the value of these coloured stones even as the price of traditional white diamonds falls on world markets.

A 9.14 carat pink pear-shaped diamond is expected to realise $16m-$18m when it is auctioned at Christies in Geneva next week.

“Pink diamond prices have tripled over the past 15 years and on average would be at least 25 to 30 times the value of white diamonds,” says David Fardon, chief executive of Linneys, one of 35 ateliers mandated to buy coloured diamonds from Argyle.

By comparison, global sales of diamond jewellery fell in 2015 for the first time in six years, declining 2 per cent to $79bn. Sales of rough diamonds fell 30 per cent.

Mr Fardon says the scarcity of coloured pink, red and violet diamonds mined at Argyle has enabled them to buck the downward trend in diamond prices. He says they have become a collectable item, with some of his clients buying the stones to include as part of their retirement savings fund.

Prices are rising 15 per cent a year because of increasing awareness of rare coloured diamonds, growing demand from China and India and the fact production at the Argyle mine is only guaranteed until 2020, says Mr Fardon.

In 2013 Rio said it was extending Argyle’s life until 2020 by building an underground extension to the existing open-cut mine. But it is uncertain whether Rio will sanction any new investment to extend the Argyle mine’s life beyond that date, in part because the valuable pink diamonds make up a small fraction of the mine’s total output.

“The odds are the mine will close a year or two after that, which means these stones will become more and more valuable,” says Mr West, one of the world’s most prodigious buyers’ of pinks from the Argyle mine.

Rio would not comment on its future investment plans for Argyle.Eden Rachminov, an Israeli diamond specialist and author of The Fancy Colour Diamond Book, says the success of Rio Tinto’s pink diamonds is also down to smart marketing.

Rio Tinto “has done a terrific job in branding its stones, which tend to be more expensive than pink diamonds mined elsewhere in the world such as Russia, Africa and Brazil,” he says.

Celebrities such as Barbra Streisand, Victoria Beckham, Nicole Kidman and Princess Mary, the Australian who married the Danish crown prince, all own pinks from the Argyle mine, which are building a loyal following among the rich and famous.

Mr West says he plans to show the Argyle Violet in an exhibition at the Museum of Natural History in Los Angeles to raise awareness of coloured diamonds.

“It’s important to let the public see them and get the word out. That can only add value to the market,” he says.