Diamonds or Gold – There’s only one best friend!

At Australian Diamond Portfolio, we get asked a lot of questions about rare coloured diamonds, and the key drivers of the market. For this reason, our regular ‘In the Loupe’ market updates typically focus on the supply and demand factors impacting diamonds, and why we think prices will move higher in the coming years.

This week we wanted to write an article specifically comparing rare coloured diamonds with gold, as this is a question we are often asked by our clients.

Over the next few weeks we will follow up with other articles comparing rare coloured diamonds with housing, and also look at diamonds in the context of superannuation investments, another popular topic amongst our client base.

Diamonds or Gold – There’s only one best friend!

To get our analysis started, let’s look at what gold and rare coloured diamonds have in common, and their similarities as investments.

- Both are commodities in nature

- Both are physical tangible assets

- Both have increased in price over the past 15 years

- Both are limited in supply

- Both are highly desired by investors all over the world

- Both benefit from a falling Australian dollar

- Now let’s look at some of the differences between the two investments.

Gold is liquid, but diamonds are easy to buy and sell too

Gold is very liquid and is typically able to be bought and sold within a day. Diamonds may not be as liquid, but they are also not as hard to sell as many people might think. Whilst most of our clients at Australian Diamond Portfolio are long-term investors who invest in diamonds with a 5 or more-year timeframe, they are comforted by the fact that should they want to liquidate their holdings, they can typically do so within 2-3 months.

Gold returns are good. Pink diamond returns are better.

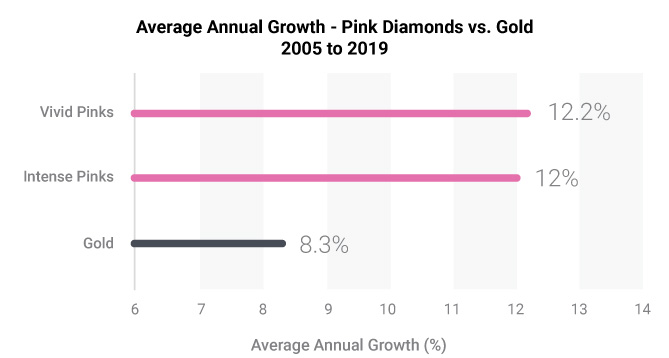

Since 2005, the price of gold has risen by just over 8% per annum.

Whilst there is nothing wrong with a return like that, diamonds, particularly the Fancy Intense Pink and Fancy Vivid Pinks that we specialise in at Australian Diamond Portfolio have done far better, rising by approximately 12-12.2% per annum.

You can see the difference in returns in the chart below.

Source: Australian Diamond Portfolio, FCRF.

What do those return differences mean in dollars I hear you ask? Well, on a $100,000 investment, a return difference of almost 4% per annum, compounded over 13 years equates to over $200,000.

The gold investor’s portfolio is now worth almost $300,000, whereas a fancy intense or fancy vivid pink diamond investor is sitting on stones worth just under $500,000.

We know which one we’d prefer.

Diamond returns are more stable

Not only have diamonds outperformed gold since the early 2000s, but they’ve been far more stable as well. Indeed, over the past decade and a half, pink diamonds have never recorded an annual fall in value, having some years where prices increase moderately, and other years where they rally by over 40%.

Gold on the other hand has had 2 years where the price has gone backwards, in particular in 2013, when the price dropped by 27%.

With diamonds you can specialise

With gold, every investor around the world gets the same return, as the asset is entirely homogenous. Whilst that makes gold simple, the downside to that simplicity for a return maximising investor is that there is no capacity to specialise.

With diamonds, you do have the opportunity to specialise. Provided you invest in the right stones that have the cut, clarity and hue that the market is looking for, then you will be able to generate above market averages.

This is also a major reason why you want to work with a leading diamond brokerage, so you can be sure you are investing in high quality stones.

Diamonds are truly rare

Whilst gold is limited in supply, the reality is that the total stockpile of above ground is already huge. Indeed, it is valued at approximately USD $8 Trillion. Every year the stockpile grows too.

Rare coloured diamond is, as the name suggest, truly rare, something that will only become more apparent with the pending 2021 closure of the Argyle Mine in Western Australia.

Diamonds are more discrete

Finally, whilst a kilo of gold is about the size of an iPhone and will fit in your trouser pocket, nothing beats diamonds as a form of discrete wealth. You can concentrate a huge amount of wealth inside tiny stones of unparalleled beauty.

Conclusion

So, there you have it. Whilst there are some similarities between the two asset classes, when it comes to long-term performance, lower volatility, true rarity and the ability to specialise, there are a number of advantages to investing in rare coloured diamonds.

It’s something we help clients of Australian Diamond Portfolio do every day.